Approach

Luccro deploys three top level tools for predicting price action – Technical Analysis, Sentiment Analysis and Strength Analysis. The primary signals are generated through technical analysis, while the other two provide supporting analysis to enhance or reduce the confidence in the action being considered. Technical analysis is based on the Dow Theory.

According to this theory:

- The market studies everything about pricing. The current asset prices integrate all existing, past and future details. With regards to Forex, it would consist of a variety of variables like past, present and future demands and market regulations that impact the price.

- Traders deduce what the price suggests regarding market sentiments to make smart pricing decisions for future.

- Price movements follow trends. They are not random. The trends can either be short or long-term. Chartists strive to make profit from these (price) trends.

- Technical traders focus more on the price action than each variable that creates a ripple in the (price) movement.

- History repeats itself in the market. In other words, it is possible to study market psychology. Traders also react the same way if the stimuli stays similar.

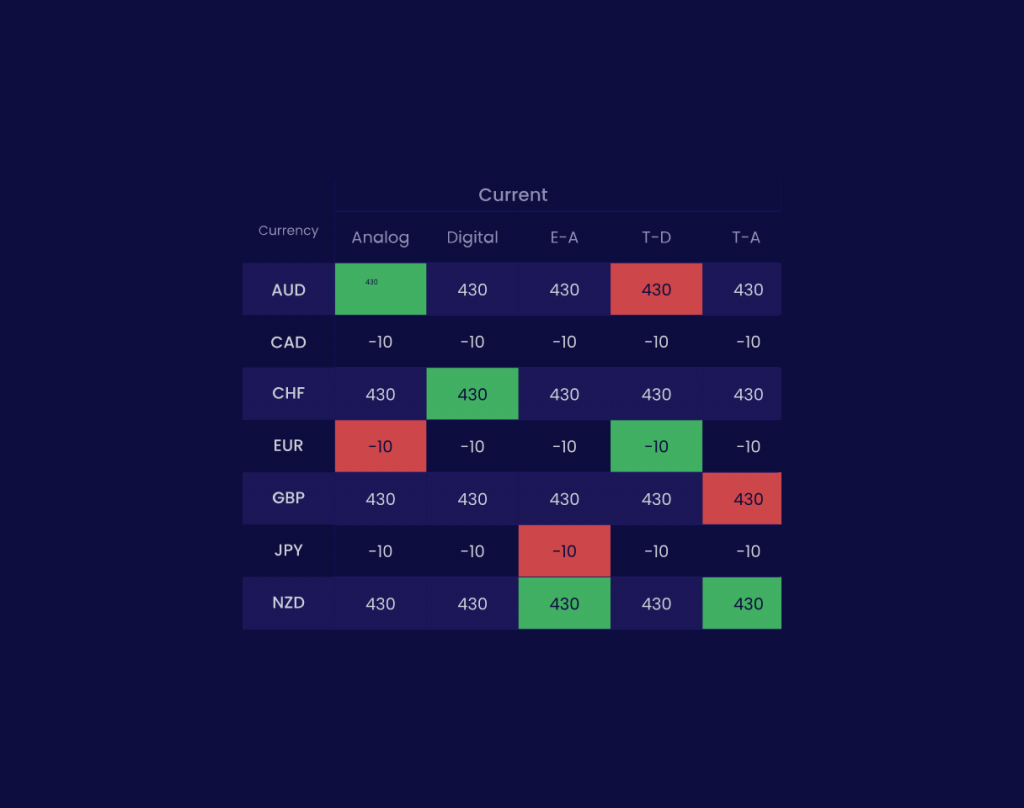

Strength Analysis

Currency trading always involves a pair, with one fiat currency being sold against the other. The price action indicates the relative strength of the base currency against the quote currency. The currency strength map provides the measure of strength of a currency against other major currencies. Two different types of strength maps are provided:

1. Digital strength comparison provides a binary view of the pair to determine which pair is “winning” during the time period in question. The winning currency is awarded two points, while the losing currency is given zero points. The summation of the scores defines the strongest and weakest currencies without providing a measure of the strength itself.

2. Analog strength comparison provides the currency strength in actual number of pips for the defined time period. When used together with the digital strength measurement, it provides a grading scale for the currencies regarding their overall strength and ranking.These strengths are computed using different time frames in three different modes:

- Current period strength, which provides strength for the current time period (in the traditional candlestick patterns time frame),

- Trailing period strength, which looks from the current point into the past for the length of that period, and

- Extended period strength, that originates from the start of the previous candlestick.

Sentiment Analysis

In addition to fundamental and technical analysis, market sentiment also influences price action. Fear and Greed are two strong sentiments that impact buying and selling in the market.

Luccro provides tools for assessing this sentiment using Natural Language Processing techniques. Trader comments are collected on a continuous basis using social media feeds, web sites and trading forums. The text data is analyzed using a sentiment engine trained specifically for financial markets to evaluate the sentiment level on a granular scale. The aggregated value is used as a quantitative measure of the short term market sentiment. This serves as a supporting measure to enhance or reduce the confidence level in any recent trading signals.

Technical Analysis

The foundation of technical analysis is built on the belief that price action and historical trading activity of financial securities are valuable indicators of future price movement. Detection of cyclical patterns in the past can help locate future trading opportunities.

When dealing with 24×7 markets, it is not possible to analyze all pairs of interest all the time. Luccro technical analysis tools serve as a trader’s eyes in an attempt to continuously discover patterns of interest and alert the traders to actionable data. These patterns include auto-detection of trend lines, consolidation patterns, Fibonacci analysis, candlestick patterns and confluence analysis around these patterns.

The composite analysis of these patterns leads to location of low risk trading opportunities, whose confidence can be further enhanced if the Strength and Sentiment analysis support them.